Pricing for our Virtual CFO Services

Engagement

Structure

Colfax partners with businesses for the long term, serving as an extension to our clients' in-house finance teams. Our engagements are recurring, fixed fee arrangements.

Price

Guidance

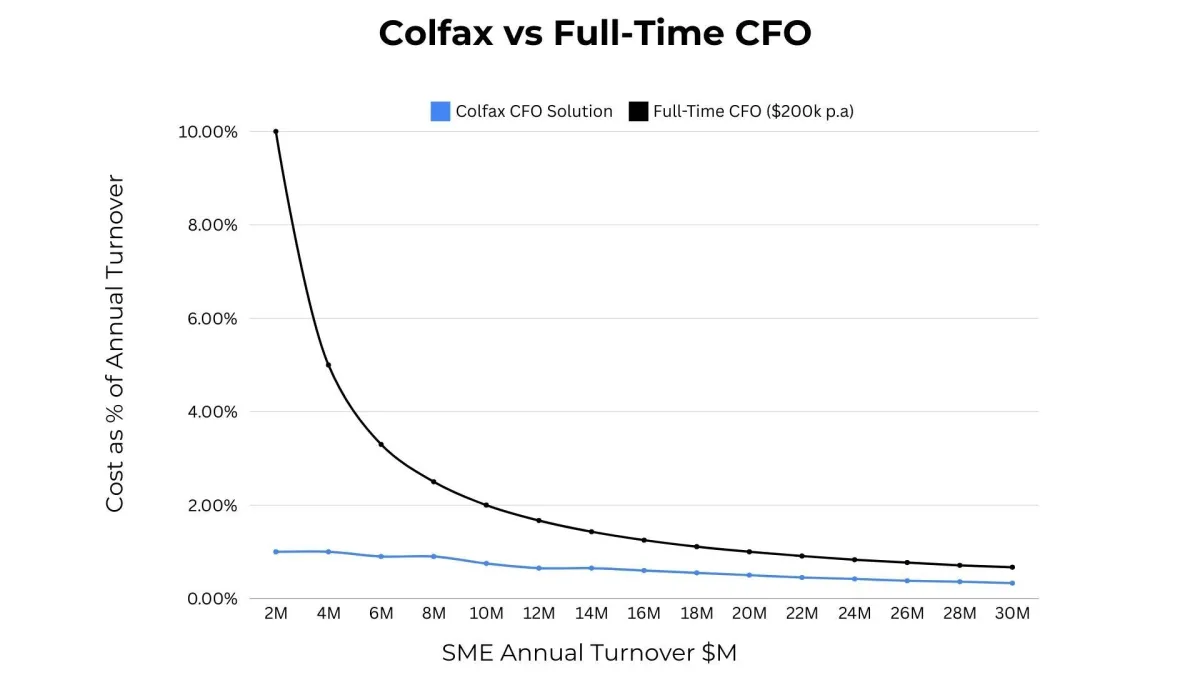

For businesses with annual turnover under $30 million, our fees typically range between 0.25% and 1.00%

of revenue, with the percentage decreasing as your business grows.

Providing

Examples

$2M Turnover Business:

Fee of ~$20k/year (1.00% of revenue)

$10M Turnover Business:

Fee of ~$75k/year (0.75% of revenue)

$20M Turnover Business:

Fee of ~$100k/year (

0.50%

of revenue)

Pricing for our services is always specific to the tailored services we are engaged to provide. That said, our prices usually fall within a predictable range. As we value transparency and simplicity, we're happy to share that predictable range here on our website.

Why SMEs under $30M Choose Colfax Over a Full-Time CFO

COLFAX Strategic CFO

Cost Efficiency: Colfax offers expert CFO services for a fraction of the cost of a full-time hire, allowing SMEs to allocate resources more effectively.

Flexible Engagement: Our services are tailored to your needs, with no long-term commitments. You can scale support up or down as your business evolves.

Immediate Access to Expertise: With Colfax, you can engage financial leadership quickly, enabling you to address pressing financial issues without delays.

Comprehensive Support: Our CFOs bring insights from a diverse portfolio of businesses, providing valuable perspectives that drive better decision-making.

No Hidden Costs: You avoid additional on-costs associated with full-time employees, such as leave entitlements, work cover, and payroll tax.

Focus on Critical Financial Areas: For up to 75% less than an in-house employee, you gain support for crucial financial aspects, from strategic planning to financial reporting.

Full-Time In-house CFO

Costly Skill Development: For SMEs, maintaining the skills of in-house finance professionals can require considerable time and expense, diverting funds from growth initiatives.

Limited Fresh Perspectives: In-house teams may struggle to provide new insights, potentially leading to missed opportunities for innovation and improvement in financial strategy.

Lengthy Hiring Process: Recruiting senior finance professionals can be a drawn-out and expensive process, which may not align with the fast-paced needs of growing SMEs.

High Salary Expectations: In-house senior finance professionals often command salaries exceeding $200,000/year, a significant investment for businesses with annual revenues under $30M.

Cost vs. Benefit Dilemma: The financial gains from in-house CFOs are frequently offset by their high costs, leaving many SMEs worse off than before, especially when budgets are tight.

Engaging Colfax vs Employing a CFO

Our team of finance experts work complimentary to your existing finance and leadership team members, providing assistance when needed and saving you significant cost when compared to hiring a full-time senior finance professional in-house.

Colfax

We're continually investing to develop and enhance relevant skillsets.

We bring you the insights from working with a broad portfolio of businesses.

We can quickly be engaged and put to work for you right now.

Depending on the services you require, our fees can be less than $1,000 + GST per month.

For 75% less than an in-house employee, you get help with many of the most commercially critical aspects of your finances.

In-House

Considerable time and expense are needed to keep employee skills current.

Gaining fresh perspectives from in-house employees is often a challenge.

Hiring senior finance professionals is usually an expensive lengthy process.

In-house senior finance professionals are often more than $12,000 / month ($150,000 / year).

Financial benefits generated from in-house finance professionals are often more than offset by their cost, leaving many SMEs worse off.

Why Choose Colfax

Understand

Your Business

We start with taking the time to understand your business, its operations, and the goals you're pursuing.

Streamline

Finances

We streamline financial data to provide clear, actionable insights that enable better decision-making.

Tell Your

Financial Story

We present a cohesive narrative for your business that highlights performance and growth opportunities.

Drive

Accountability

Collaborating closely with your leadership team, we ensure accountability and alignment to drive business performance.

Liability limited by a scheme approved under Professional Standards Legislation.

Colfax Pty Ltd